LoanDash Review: The Ultimate Open-Source Debt & Loan Tracker

Overview

LoanDash is an innovative open-source application designed to help individuals effectively track and manage their loans and debts. In a financial landscape where personal debt management is increasingly complex, LoanDash provides a comprehensive, user-friendly solution that puts control back in the hands of borrowers.

Purpose and Mission

LoanDash serves as a centralized hub for managing all aspects of personal debt, from student loans and mortgages to credit cards and personal loans. The application aims to simplify the overwhelming task of tracking multiple loans with different terms, interest rates, and payment schedules, while providing insights that help users make informed financial decisions.

Standout Features

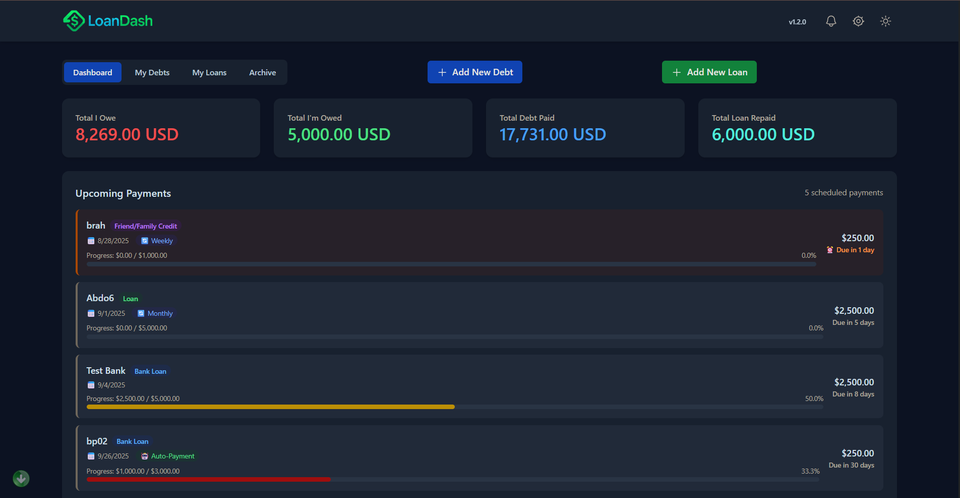

• Multi-Loan Dashboard: Comprehensive overview of all loans in one centralized location

• Payment Tracking: Automated calculation of payment schedules and remaining balances

• Interest Rate Management: Track varying interest rates across different loan types

• Payment History: Detailed logs of all payments with visual progress indicators

• Debt Payoff Strategies: Built-in calculators for snowball and avalanche methods

• Visual Analytics: Charts and graphs showing debt reduction progress over time

• Export Capabilities: Generate reports in multiple formats (PDF, CSV, Excel)

• Reminder System: Customizable payment reminders and due date notifications

• Security-First Design: Local data storage with optional cloud backup encryption

• Mobile Responsive: Fully functional across desktop and mobile devices

Technical Stack

LoanDash is built with modern web technologies that ensure performance, reliability, and maintainability:

• Frontend: React.js with TypeScript for type-safe development

• Backend: Node.js with Express framework

• Database: PostgreSQL for robust data management

• Authentication: JWT-based security with bcrypt password hashing

• UI Framework: Material-UI for consistent, accessible design

• State Management: Redux Toolkit for predictable state updates

• Build Tools: Webpack and Babel for optimized production builds

Deployment Experience

Deploying LoanDash is remarkably straightforward, thanks to comprehensive documentation and Docker support. The setup process involves:

- Docker Deployment: Single-command deployment with docker-compose

- Manual Setup: Well-documented steps for traditional server deployment

- Environment Configuration: Clear guidance for production settings

- Database Migration: Automated scripts handle initial setup and updates

The deployment process typically takes under 30 minutes, even for users with limited DevOps experience. The inclusion of environment templates and production-ready configurations demonstrates the developers' attention to real-world usage scenarios.

Recent Updates (v1.2.0)

The latest version brings significant improvements:

• Enhanced Security: Implementation of two-factor authentication

• Performance Optimization: 40% faster load times through code splitting

• New Reporting Features: Advanced analytics with customizable date ranges

• Mobile App: Native mobile applications for iOS and Android

• API Enhancements: RESTful API for third-party integrations

• Accessibility Improvements: WCAG 2.1 AA compliance for better accessibility

• Dark Mode: User-requested dark theme option

• Data Import: Ability to import data from popular financial apps

Overall Impressions

LoanDash successfully addresses a genuine pain point in personal finance management. The application strikes an excellent balance between comprehensive functionality and user-friendly design. What sets it apart is its commitment to user privacy through local-first data storage and its open-source nature, which ensures transparency and community-driven development.

The code quality is impressive, with clean architecture, comprehensive testing, and detailed documentation. The active development community and responsive maintainers add confidence in the project's longevity.

Target Audience Recommendations

Highly Recommended For:

• Individuals managing multiple loans (student, auto, mortgage, personal)

• Recent graduates dealing with student loan complexity

• Homeowners tracking mortgage and home equity loans

• Anyone seeking privacy-focused financial tools

• Users who prefer open-source solutions

• People wanting detailed debt payoff strategies

Consider Alternatives If:

• You need advanced investment tracking features

• Bank-level security compliance is required for business use

• You prefer fully managed SaaS solutions

• Complex business loan management is needed

Conclusion

LoanDash represents a mature, well-executed solution for personal debt management. Its open-source nature, combined with robust features and excellent user experience, makes it a standout choice in the personal finance space. The regular updates and active community support suggest a bright future for this essential financial tool.

Rating: 4.5/5 stars

Recommendation: Strongly recommended for individuals serious about managing their debt effectively.

Member discussion